Get in touch with Sherry Bowman for expert real estate guidance and personalized service!

Elite Broker Blogs

━━━━━━━━

Cost of Living in Pleasant View: What Homebuyers Should Expect

When exploring the cost of living in Pleasant View, many buyers turn to a trusted realtor in Pleasant View to help them understand local housing costs and long-term affordability. From home prices to daily expenses, knowing what to expect can help you make confident decisions in the Pleasant View real estate market.

Single-family homes in Pleasant View typically range from $300,000 to $500,000, while townhomes and condos often start around $250,000, making them attractive options for first-time buyers. Property taxes usually fall between 1% and 1.5%, and homeowners insurance averages $800 to $1,200 annually. Utilities, groceries, healthcare, and childcare also factor into the overall cost of living.

Keep reading to get a full breakdown of what homebuyers should know when working with a Pleasant View real estate agent.

Overview of Pleasant View’s Housing Market

The Pleasant View housing market has evolved significantly in recent years, drawing increased interest from buyers relocating to the area. A mix of established neighborhoods and new construction provides options for a wide range of budgets and lifestyles.

Many Pleasant View realtors note growing demand due to the area’s community feel, access to amenities, and expanding infrastructure. As a result, both buyers and renters face a competitive market, especially for well-priced homes.

If you’re considering buying or investing, partnering with an experienced real estate agent in Pleasant View can help you navigate current trends and identify opportunities.

Average Home Prices in Pleasant View

Home prices in Pleasant View real estate reflect the area’s rising popularity.

Single-family homes: $300,000–$500,000 on average

Townhomes and condos: starting around $250,000

Pricing varies based on location, square footage, updates, and neighborhood amenities. A knowledgeable realtor in Pleasant View can help you compare similar properties and determine whether a home is priced competitively.

With continued growth and buyer interest, many Pleasant View homes for sale retain strong long-term value, making this area appealing for both homeowners and investors.

Renting vs. Buying: What to Consider

Deciding whether to rent or buy in Pleasant View depends on your financial goals and timeline.

Renting often requires less upfront cash and offers flexibility, which may appeal to buyers unsure about long-term plans. Buying, however, allows you to build equity and benefit from appreciation in the Pleasant View housing market.

A Pleasant View real estate agent can help you analyze current market conditions and determine whether buying now or renting makes more financial sense for your situation.

Property Taxes and Insurance Costs

Property taxes are an important consideration when purchasing Pleasant View homes for sale. Most homeowners can expect annual property taxes between 1% and 1.5% of assessed value.

Homeowners insurance typically ranges from $800 to $1,200 per year, depending on coverage and provider. Many Pleasant View realtors recommend shopping rates early, as insurance costs can affect monthly affordability and loan approvals.

Utility Expenses: What to Expect

Beyond your mortgage, utilities play a significant role in the cost of living in Pleasant View.

Common expenses include electricity, water, gas, and trash service. Seasonal fluctuations—especially during summer and winter—can affect energy bills. Many real estate agents in Pleasant View suggest energy-efficient homes or upgrades to help reduce monthly costs.

Transportation Costs and Accessibility

Pleasant View offers convenient transportation options that appeal to commuters and families alike.

Public Transit Options Available

Local bus routes connect neighborhoods, schools, and shopping areas. Rideshare services and bike-friendly routes provide additional flexibility.

Average Commute Times

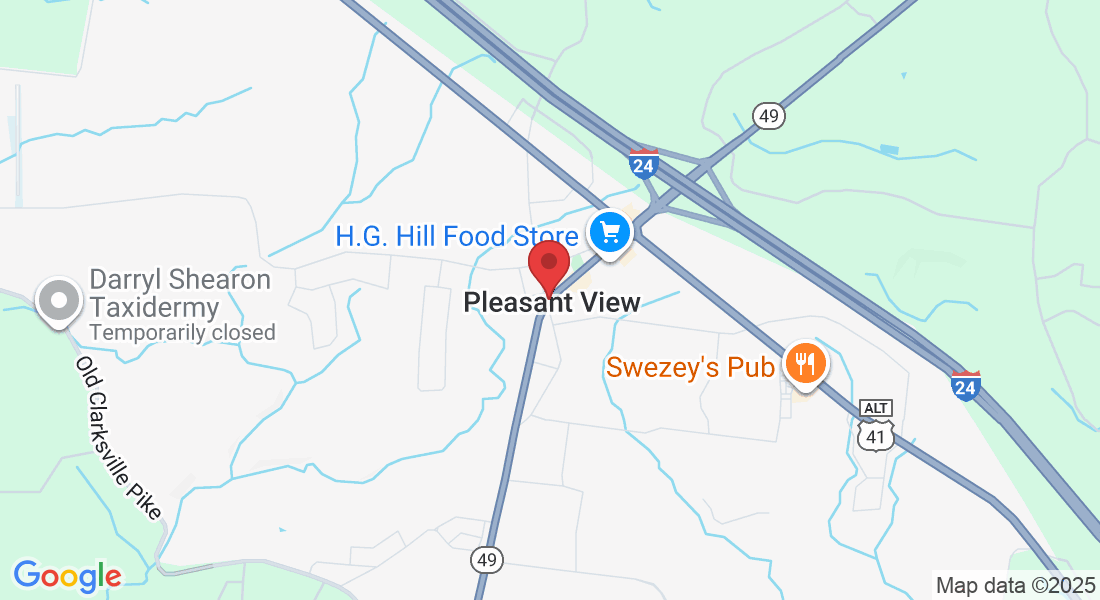

The average commute time is about 25 minutes, making Pleasant View attractive for buyers seeking accessibility without urban congestion. Proximity to major highways is often highlighted by Pleasant View real estate agents as a key selling point.

Parking Costs Insights

Street parking is generally available, with metered areas ranging from $1 to $2 per hour. Monthly permits typically cost $50 to $100, depending on location.

Grocery and Food Prices in Pleasant View

Day-to-day expenses like groceries are another factor buyers evaluate with their realtor in Pleasant View.

Average prices include:

Bread: ~$3

Milk: ~$3.50 per gallon

Eggs: ~$2.50 per dozen

Chicken breast: ~$4 per pound

Dining out varies widely, with mid-range restaurant meals averaging $15–$25 per person. Pleasant View offers diverse dining options that appeal to families and professionals alike.

Healthcare Expenses and Options

Healthcare access is a major consideration for many buyers entering the Pleasant View real estate market.

The area offers clinics, hospitals, and pharmacies with varying pricing structures. Insurance coverage plays a large role in out-of-pocket costs, and preventive care can help reduce long-term expenses. A Pleasant View real estate agent can often point buyers to nearby healthcare facilities as part of the relocation process.

Education Costs: Schools and Childcare

Families considering Pleasant View homes for sale often prioritize education.

Public School Funding

Public schools are funded through local property taxes and state allocations. Strong funding typically supports better facilities, programs, and class sizes—factors that influence home values.

Childcare Expenses Overview

Full-time childcare costs generally range from $800 to $1,500 per month. Many Pleasant View realtors advise families to explore childcare options early due to waitlists.

Private School Options

Private school tuition varies based on curriculum and reputation. Some schools offer financial aid, which can help offset costs for families planning long-term residency.

Recreational and Entertainment Spending

Recreation is a key part of life in Pleasant View. Parks, sports facilities, community events, dining, and entertainment venues contribute to the area’s appeal.

Many Pleasant View real estate agents highlight local recreation as a lifestyle benefit that adds value beyond housing alone.

Conclusion

Understanding the cost of living in Pleasant View is essential for making smart real estate decisions. From housing prices and property taxes to utilities, healthcare, and education, each factor plays a role in long-term affordability.

Whether you’re buying your first home or relocating, working with a knowledgeable realtor in Pleasant View can help you navigate the market with confidence. With proper planning and expert guidance, Pleasant View offers a balanced lifestyle and strong real estate potential.

CONTACT

Call Sherry Bowman today for expert real estate guidance!

Reach out now, and Sherry Bowman contact you promptly!